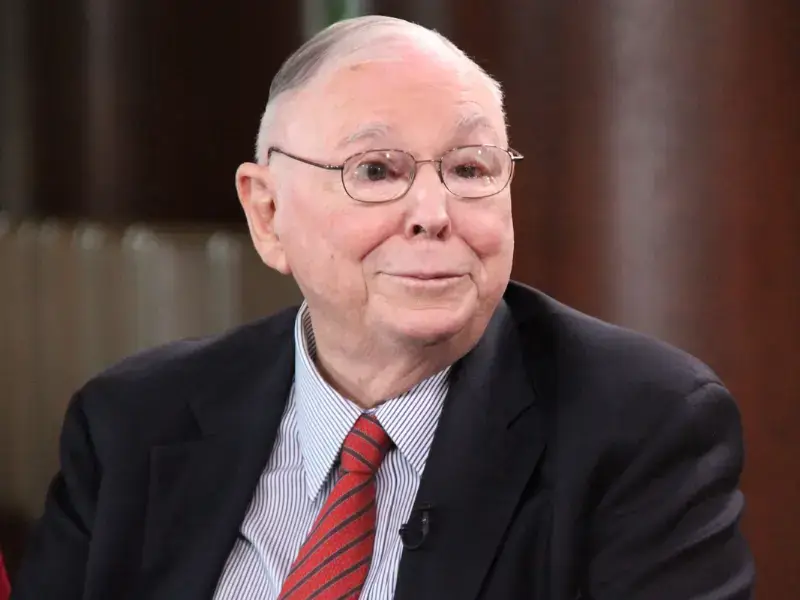

Charlie Munger

Charlie Munger, the esteemed American investor, businessman, and philanthropist, was widely regarded as one of the most brilliant minds in the world of finance. As the long-time business partner of Warren Buffett and Vice Chairman of Berkshire Hathaway, Munger’s influence on the investment world extended far beyond his financial achievements.

Born in 1924 in Omaha, Nebraska, Munger’s journey to success was marked by determination and a thirst for knowledge. He attended the University of Michigan for his undergraduate studies and later earned a law degree from Harvard University. His legal background provided him with a foundation of analytical thinking and the ability to dissect complex problems—a skill that served him well in his future endeavors.

Munger’s path to becoming an iconic figure in the world of finance began when he met Warren Buffett at a dinner party in 1959. Their shared values, investment philosophies, and intellectual compatibility led to a lifelong partnership that would transform the investment landscape. Together, they turned Berkshire Hathaway into a global conglomerate and created immense wealth for their shareholders.

One of Munger’s distinguishing attributes was his multidisciplinary approach to problem-solving. He was an avid reader with a wide range of interests, including psychology, history, mathematics, and physics.

Munger believed that incorporating ideas and concepts from various disciplines into one’s thinking led to better decision-making and a deeper understanding of the world. This approach, often referred to as “mental models,” was a cornerstone of his investment success.

At FCC, we believe multidisciplinary thinking is a crucial aspect of our success. We rely on a diverse range of disciplines such as Mathematics and Statistics, Computer Science, Machine Learning, Operations Research and Optimization, Risk Management and Portfolio Theory, and Market Microstructure to develop sophisticated trading strategies and navigate the complexities of financial markets. Multidisciplinary thinking enables us to uncover unique insights, explore novel trading approaches, and enhance our overall trading performance.

One of our favorite thinking techniques at FCC is Munger’s principle of “inversion.” He often advised approaching problems by thinking backward—identifying what not to do rather than focusing solely on what to do. This inversion technique helps avoid costly mistakes and leads to better decision-making.