Warren Buffett

One of the central tenets of Warren Buffett’s risk management is the concept of a margin of safety. Buffett advises investors to only purchase stocks at prices significantly below their intrinsic value. This provides a buffer against adverse market conditions or changes in a company’s fortunes. We build ample cushion in our trading strategies so that we do not suffer in a big way if we are wrong.

Buffett is known for his long-term investment horizon. He is not swayed by short-term market fluctuations and aims to hold investments for the long haul. This approach allows him to ride out market volatility and benefit from the compounding effect of returns over time. At FCC, we are a private investment firm and ignore day-to-day fluctuations in our results and are solely focused on long-term compounding.

Buffett is highly selective in his investments and sticks to industries and businesses he understands well. He avoids sectors outside his circle of competence, where the risks may be harder to assess accurately. At FCC, we have an acute sense of where our strengths lie. We strongly stay within our circle of competence and advance its frontiers methodically and rigorously.

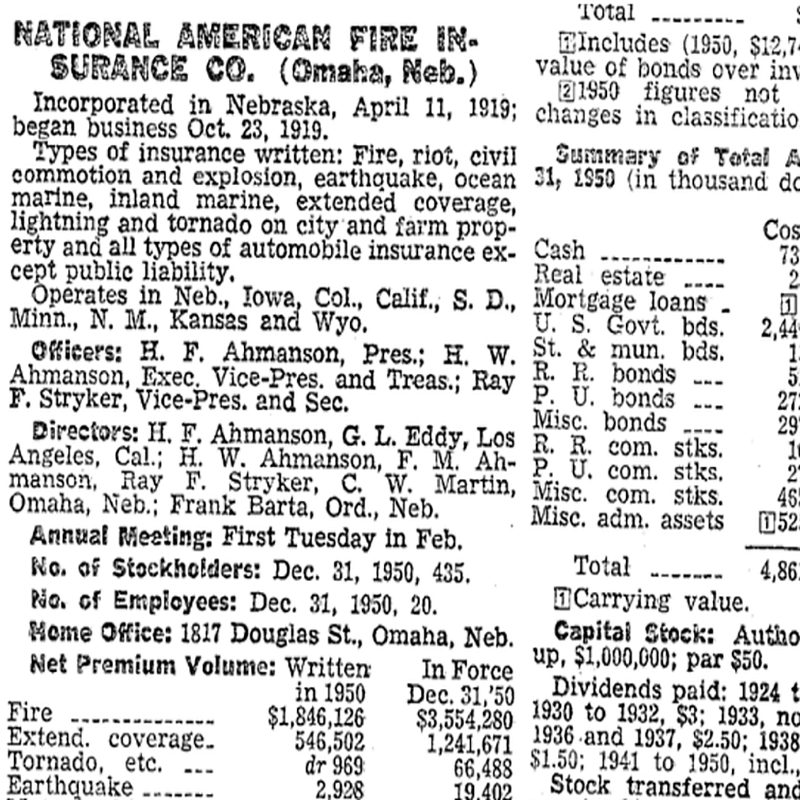

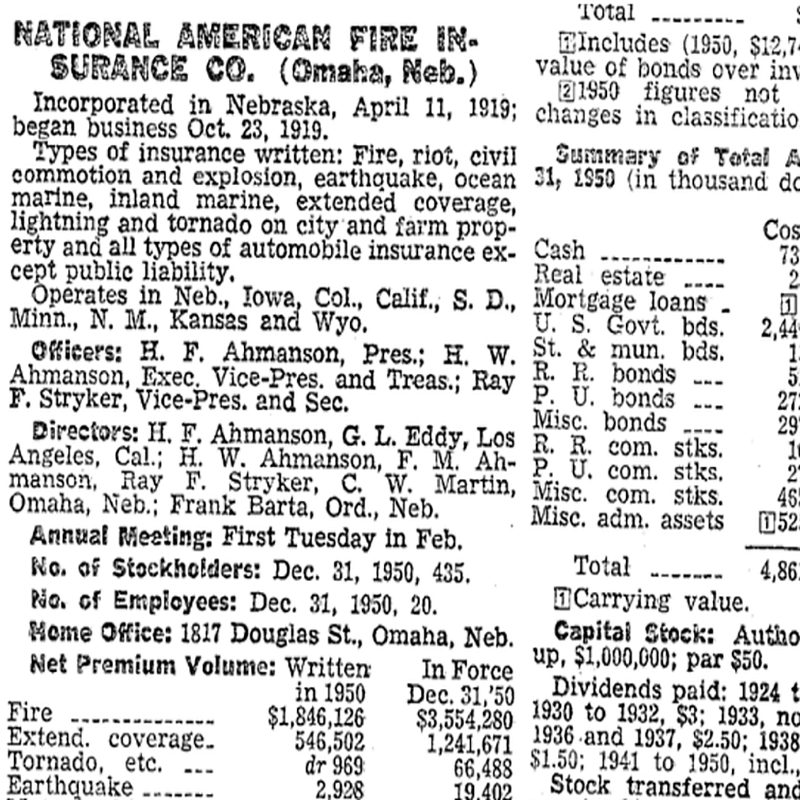

Known for his voracious reading habits, Buffett continuously seeks to expand his knowledge base. He reads widely about various industries, companies, economic trends, and historical contexts to inform his investment decisions. He thumbed through thousands of pages of obscure Moody’s manuals in his 20s to find undervalued securities. His research process serves as the inspiration for the diligence and deep research that forms the underpinning of our work at FCC.

Buffett is highly selective in his investments and sticks to industries and businesses he understands well. He avoids sectors outside his circle of competence, where the risks may be harder to assess accurately. At FCC, we have an acute sense of where our strengths lie. We strongly stay within our circle of competence and advance its frontiers methodically and rigorously.

Known for his voracious reading habits, Buffett continuously seeks to expand his knowledge base. He reads widely about various industries, companies, economic trends, and historical contexts to inform his investment decisions. He thumbed through thousands of pages of obscure Moody’s manuals in his 20s to find undervalued securities. His research process serves as the inspiration for the diligence and deep research that forms the underpinning of our work at FCC.